Georgia Tax Rebate for Eligible Taxpayers

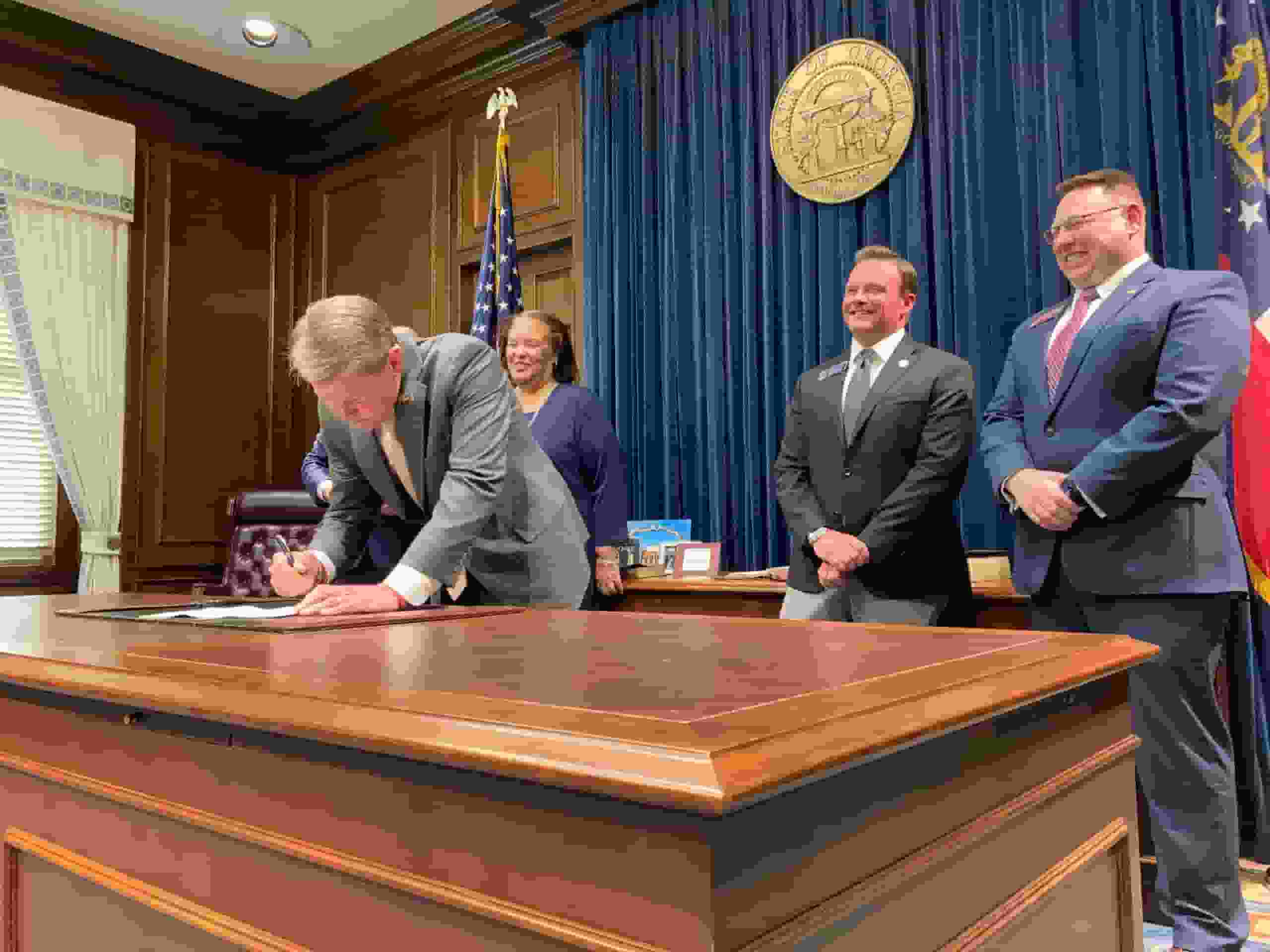

Residents can look forward to another round of Georgia tax rebates, thanks to a recently passed bill signed into law by Governor Brian Kemp.

After signing the bill, Governor Kemp expressed his pride in providing Georgia tax rebates to the state’s taxpayers for two consecutive years, with over a billion dollars returned last year, US Sun reported. He also acknowledged the General Assembly members who supported this initiative to assist Georgia families in dealing with a 40-year high inflation rate, which was a campaign promise during his successful re-election bid in the past fall.

The funds are a segment of the state’s substantial $6.6 billion budget surplus, amounting to $1 billion. The Georgia tax rebate is the same size as last year’s, with solo filers receiving $250, heads of households receiving $375, and couples receiving $500.

READ ALSO: Georgia Midyear Budget: Property Tax Cut and Transportation Funding Restored

Who qualifies for the Georgia Tax Rebate?

To qualify for this year’s Georgia tax rebate, you must have filed both your 2021 and 2022 taxes. You will not receive an amount greater than your previous income tax obligation. Individuals who are not state residents or are claimed as dependents on someone else’s tax return are ineligible for the Georgia tax rebate.

The Georgia Department of Revenue intends to start sending out the rebates in two-to-eight weeks, with those who file on or before April 18 expected to receive their cash by July 1.

The Georgia tax rebates are a welcome boost for residents struggling with the pandemic’s economic impact and other financial challenges. The funds can cover necessary expenses, pay down debt, or build savings. For those who qualify for the Georgia tax rebate, it’s important to keep an eye on your mailbox or bank account in the coming weeks for these much-needed payments.

READ ALSO: The Social Security Gender Gap: How Women’s Earnings Affect Their Retirement Benefits