On February 1, 2024, at the Lok Sabha, Union Finance Minister Nirmala Sitharaman will deliver the Union Budget 2024–25. An “Interim Budget” for the fiscal year will begin on April 1, 2024, and conclude on March 31, 2025.

Timeline of Union Budget 2024–25:

On Thursday, February 1, 2024, at 11:00 AM, the Union Budget for the fiscal year 2024–25 will be presented to the Indian parliament. A “Interim Budget” has been proposed for the fiscal year that begins April 1, 2024, and concludes March 31, 2025.

Five major social areas—the welfare of the impoverished, women, youth, farmers, and tribal people—will probably be the budget’s main priorities. Funding is anticipated to continue to be allocated to the agriculture industry, and capital expenditure spending would likely rise.

The budget will only be in place until a new administration is chosen and the results of the Lok Sabha Elections 2024 are known. The funding will be outlined for the first few months of FY 2024–2025 or until the new administration assumes power.

What is the Purpose of an Interim Budget?

Important explanations for presenting an interim budget rather than a complete budget during the Lok Sabha election year:

- Electoral laws: In India, electoral laws prohibit the departing administration from announcing significant financial commitments during the campaign for office.

- Continuity of vital services: An interim budget guarantees financing essential government functions such as defense, wages, and continuing initiatives.

- Limited policy changes: Major policy reforms or considerable tax adjustments are often avoided in an interim budget to allow the next administration to create its own plan.

- Fiscal prudence: To ensure financial stability during the transition phase, the departing administration prioritizes upholding fiscal discipline and controlling the deficit in an interim budget.

- Short-term outlook: Since an interim budget only covers the period until the next administration takes office, it avoids making long-term promises and concentrates on essential expenditures instead.

- Leveling the playing field: An interim budget keeps the climate fair and impartial for the next elections by guaranteeing that the departing administration makes no significant policy decisions that might unjustly favor particular industries or parties.

How will the Union Budget 2024–2025 be Received?

Although substantial tax adjustments and policy changes are uncertain, the interim budget may prioritize the following areas:

- Sustaining current initiatives: It is anticipated that essential government initiatives in social welfare, infrastructure, agriculture, and defense will continue to be funded.

- Measures aimed at winning over voters: To win over people, the government may propose populist policies such as tax breaks for particular industries, subsidies, or higher funding for social security programs.

- Fiscal prudence: Considering the uncertainty surrounding the world economy, keeping fiscal restraint and controlling the deficit will be top priorities.

- Establishing the foundation: The long-term policy goals the next administration may pursue following the elections may be alluded to in the budget.

What is Excluded from the Union Budget 2024–2025?

The following is a summary of what the forthcoming interim budget will not include:

- New Flagship Schemes: There won’t be any significant changes to current flagship programs or big openings of new ones. The maintenance of existing plans and their continuation will be the main priorities.

- Significant Tax Reforms: It is doubtful that direct or indirect taxes, such as income tax or GST, would alter much.

- Long-Term Fiscal Plans: Detailed long-term fiscal or economic plans are not included in the interim budget. Following the elections, these will be left to be formulated by the next administration.

- Contentious Policy Proposals: Major, possibly divisive policy choices that cause discussion or public backlash are typically avoided in an interim budget.

- New Commitments Beyond Vital Spending: The interim budget prioritizes continuing programs, defense, and wages more than other vital expenses. It seems doubtful that new commitments requiring a significant investment of resources for new projects or activities would occur.

- Political Promises or Populism: An interim budget often avoids overt populist initiatives intended to win over voters, even when some measures appealing to particular groups or industries may be revealed.

- Extensive Vision for the Future: The interim budget does not offer a comprehensive vision for the economy’s future; it will provide a condensed financial situation.

Important Industries:

The following are the main areas that the Union Budget 2024–2025 will concentrate on:

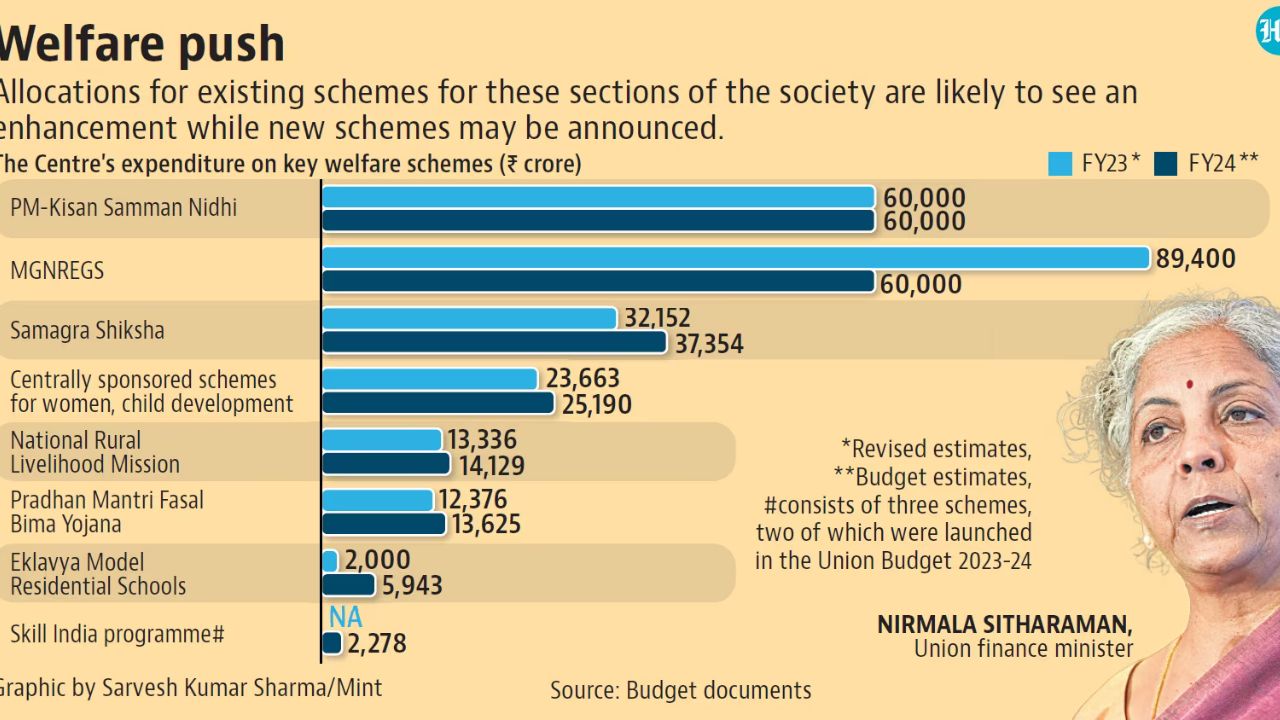

- Social Welfare: To provide income assistance and meet fundamental requirements, programs like MGNREGA, food security initiatives, and pensions for marginalized populations must get ongoing financing.

- Agriculture: Farm welfare initiatives like the PM Kisan Samman Nidhi and the Pradhan Mantri Fasal Bima Yojana are expected to continue to get financing.

- Infrastructure: Keeping up the pace of infrastructure development will be a top focus, especially in sectors like roads, trains, and renewable energy.

- Education and Healthcare: Funding for ongoing initiatives in these areas, such as the Ayushman Bharat Yojana, would be available.

- Defense: Maintaining sufficient funds for defense requirements will be a top concern considering the current geopolitical climate.

Read Also – Where’s My New Year Stimulus Check? Find Out Here.