Cost of Living Relief

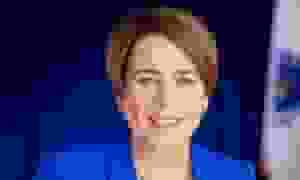

The proposed tax relief package introduced by Governor Maura Healey and Lieutenant Governor Kimberley Driscoll aims to provide Cost of Living Relief worth $2,400 to over a million Americans. The package includes several provisions, such as the Child and Family Tax Credit (CFTC) which eliminates the cap on dependents and combines the Household Dependent Tax Credit and Dependent Care Tax Credit. The CFTC would cost $458 million and benefit more than one million dependents. The Senior Circuit Breaker Credit, valued at $1,200, would be increased to $2,400 and benefit seniors in 100,000 households.

According to a published article in The U.S. Sun, the package also includes an allocation of $40 million to boost the rental deduction, benefiting 880,000 people. Additionally, the short-term capital gains tax, currently set at 12%, would be slashed to 5%. However, the package needs to be passed by the state’s Senate and House to become law.

READ ALSO: What You Need to Know About Schedule Earned Income Credit (EIC)

Eligible individuals who haven’t filed federal taxes for 2022 should also consider the Earned Income Tax Credit (EITC), which offers up to $600 to eligible individuals and higher amounts for families with one, two, or three more children. The Inflation Reduction Act brought the Solar Tax Credit into effect, allowing homeowners and renters to claim up to $8,000 for purchasing energy-efficient appliances.

Governor Healey and Lieutenant Governor Driscoll’s tax relief package aims to put more money back into the pockets of those who need it most while making key reforms in areas where the state is an outlier among others. The cost of living relief is meant to alleviate the burden on low and moderate-income households and individuals, providing financial stability and security. Eligible individuals are urged to check their eligibility and claim the benefits as soon as possible.

READ ALSO: $400 Rescue Plan Relief Payments Fo Americans: See Who Qualifies