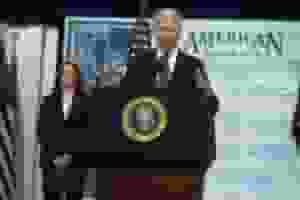

In his recent State of the Union address, President Joe Biden called on Congress to revive the expanded Child Tax Credit (CTC) policy, a key component of his Build Back Better plan aimed at reducing child poverty in the US. Biden’s address focused on economic and pocketbook issues, and the CTC expansion was highlighted as a critical component of his agenda.

The expanded CTC was implemented in 2021 as part of the American Rescue Plan to support families struggling financially due to the COVID-19 pandemic and rising inflation. The maximum benefit was increased from $2,000 to $3,000 for children aged 6 to 17, and to $3,600 for children under 6. Half of the credit was provided in advance, in monthly payments, and the other half was given as part of the household’s tax refund.

READ ALSO: Changes You Will Expect On Your 2023 Child Tax Credit

The policy had a swift and noticeable impact on child poverty, with a study from Columbia University showing that child poverty fell by more than 25% as a result of the CTC expansion. Parents reported using the advance payments for essential household expenses, such as groceries, clothing for school, and utilities. The policy also did not discourage work among parents, as some conservatives had feared.

However, Congress failed to renew the policy in 2022, which led to millions of children falling back below the poverty line in January 2022. One of the key debates around the CTC is whether or not there should be a work requirement attached to it, with most Democrats advocating for a fully refundable credit to support the poorest children and their families. Republicans, on the other hand, argue that the policy is too expensive and complicated to implement and support a more simplified and targeted policy.

Eliminating child poverty is a key goal of Biden’s presidency, and he has been advocating for the extension of the expanded CTC, along with other childcare and family-friendly tax policies. The policy has received strong support from Democrats, who have hailed the credit’s reduction in child poverty, while Republicans argue that it is too expensive and complicated. Biden’s call to revive the expanded CTC highlights the importance of addressing child poverty and providing support to families in need.

READ ALSO: Child Tax Credit: What American Families Should Expect in 2023?