Republican Gov. Greg Gianforte and the Republican majority in the Montana Legislature have both identified tax relief as one of their top priorities for the 68th Session. However, as lawmakers begin hearing the first set of major tax bills, some differences have emerged in how they want to return money to taxpayers.

The Governor has proposed a plan that includes cutting the state’s top income tax rate from 6.9% to 6.75% and increasing the state’s Earned Income Tax Credit to help low-income families. The plan also includes using some of the state’s surplus of more than $2 billion. He’s backed House Bill 222, sponsored by Rep. Tom Welch, R-Dillon, which initially proposed a rebate of up to $1,000 each of the next two years on the States property owner’s primary residence.

READ ALSO: $800 One-Time Payment for Americans in March: Check Eligibility and Act Quickly to Claim Yours

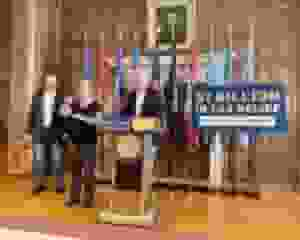

On the other hand, the Republican-led Legislature House Taxation Committee tabled House Bill 222. On the following morning, Gianforte criticized the decision at his weekly news conference and says it would delay needed relief for Montanans. Later that day, the committee revived House Bill 222 and advanced it, but not before amending it to cut the rebate to $500 each year. House Majority Leader Rep. Sue Vinton, made the initial motion to table the bill and said Republican lawmakers cut the rebate with the intention of redirecting some of the funding to an income tax rebate.

There are also differences in the way the Governor and the Legislature want to pay for the tax cuts. The Governor’s plan relies on increased revenue from economic growth and the use of reserves, while the Legislature’s plan would cut spending to fund the tax cuts.

Despite these differences, both the Governor and the Legislature are committed to providing tax relief to the people of Montana. However, it remains to be seen how these competing proposals will be reconciled as the legislative session progresses.

In any case, the lawmakers have agreed that the tax relief measures should be aimed at helping the residents of Montana, whether it be through cutting income tax, property tax, or business taxes, as well as providing credits or exemptions. It will be interesting to see how the final tax relief package will look in the end and how it will benefit the state’s residents.

READ ALSO: $250 Tax Credit Approved for Hundreds of Americans: Check Your Eligibility Today