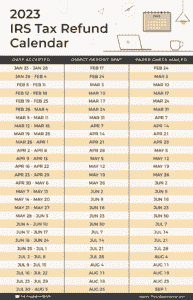

Taxpayers can expect to receive their tax refunds two weeks after filing their federal returns, as long as they file correctly and without errors, according to CPA Practice Advisor, a publication for tax professionals. The publication releases a refund timeline each year based on averages for IRS refunds over the last 20 years. However, refunds may take longer during peak filing times in April, and refunds that include the Earned Income Tax Credit or the Additional Child Tax Credit cannot be issued until mid-February by law.

The IRS typically advises taxpayers to wait 21 days after filing for their refund, which is often their largest windfall of the year. To ensure a fast refund, taxpayers are advised to file early and electronically, and use direct deposit for refunds to prevent delays. Paper returns can take longer to process, despite recent changes by the IRS to speed up the process.

READ ALSO: IRS Announcement: 2023 Tax Season Start Date and Key Deadlines

Taxpayers are also advised to have all of their personal information and tax documents ready before filling out their returns. Returns with errors or missing information may require additional review, delaying the refund. In order to file correctly and avoid delays, taxpayers should have all necessary personal information for themselves, their spouses, and dependents, including birth dates and identification numbers, as well as records of their income, such as W-2s, 1099s and other forms related to unemployment compensation, dividends, pension, annuity or retirement plan distributions.

Receipts and documentation for items such as electric vehicles, solar panel installations, side hustles, or bitcoin transactions, should also be kept on hand. Other needed items could include Form 1095 for health insurance marketplace coverage, tuition, mortgage interest, and real estate tax receipts, as well as documentation of charitable donations for itemizing using Schedule A.

If you need help filing your taxes, the IRS offers free file options and Volunteer Income Tax Assistance (VITA) offers free tax preparation for moderate- to low-income individuals, senior citizens, disabled individuals, or those who have a language barrier.

READ ALSO: Tax Deadlines 2023: Mark The Important Dates