Many people in California wonder what had happened to Governor Gavin Newsom’s proposal to offer vehicle owners a payout to help offset rising gas prices.

To lower the impact of inflation, state legislators chose to offer tax refunds to low as well as middle-income individuals.

These payouts are now being mailed to millions of Californians and loaded onto debit cards. Though several claim the cards seem to be a hoax. Others say that they have too many costs and limitations.

The Middle-Class Tax Refund raises many questions, such as why I must pay fees to receive my money. Why did the debit card comes from a bank in New York? Also, is the card authentic?

When Doris Beers of San Francisco got this mail from “Middle-Class Tax Refund” with a location in Nebraska, she was dubious.

“I almost threw it out,” Beers said. “I honestly thought it was a scam.”

When she opened it, she saw a debit card from a New York-based bank that claimed to be her California Middle-Class Tax Refund.

“I didn’t have any refunds coming from any company I knew of in New York, and it just didn’t look official,” she said.

Though it was.

The $350 state tax refund was put onto the card; millions of such refunds are presently being distributed to Californians to lower the impact of inflation.

For individuals making up to $250,000, the one-time payouts vary from $200 to $350 per person.

It troubled Beers nonetheless. The card arrived with a lengthy card holder contract along with four pages of regulations, terms & conditions, and prospective fees.

“And why, if you’re giving someone a rebate, would you charge them to use it?” she said.

Others shared their scepticism.

It is a debit card for the Californians, but the bank is in New York, so Mark in San Jose worries that it’s a ruse.

“My husband believes this is a scam, and the New York Community Bank now has our personal information,” says Carol in San Francisco.

There are already con artists attempting to trick taxpayers into providing personal data to activate their cards.

So how can you know whether you have the real deal?

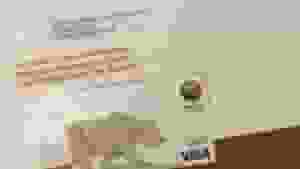

The envelope resembles the one in our video, with Omaha, Nebraska, written as the return address.

Most importantly, only this number, 1-800-240-0223, must be called to activate the genuine card.

Calling any other number that offers to activate the card is not advised.

When you call, they will ask you to enter your Social Security number’s last six digits.

But after you activate, beware of fees.

At non-network ATMs, such as those at large banks, each withdrawal costs $1.25. A bank’s over-the-counter cash withdrawal costs $1.25 as well.

Cash withdrawals at Money Network ATMs are free and primarily found inside pharmacies and grocery stores.

Additionally, using them for shopping is free.

Beers only request a check.

“A bank is making money off these millions of cards, and taxpayer money goes to a bank in New Jersey. That was the last straw for me,” she said.

It is a New York bank. To give nearly 11 million Californians debit cards, California is giving Money Network of Georgia $25 million. A partner is a bank from New York.