Another round of stimulus money for those eligible will be coming from Child Tax Credit. The funds can be expected to be directly deposited through a person’s bank account or mail by check.

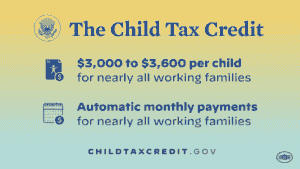

The Child Tax Credit is part of the American Rescue Plan, and the money that people can expect depends on the child’s age. For children over six years old, the stimulus money can be up to $3,000. For those under six, it can go as much as $3,600. This would be the next batch of such stimulus after the first one was rolled out last July 15. This upcoming batch will be arriving on Aug. 13. However, those who only have mail information could receive their checks a little later.

The subsequent batches would be given around the same time for the coming months until the end of the year. The amount that those eligible will receive is only half of the total because the next half will be claimed after filing the 2021 return.

If you have not filed a return yet, but you are eligible to receive the new credit, you can sign up here: https://www.irs.gov/credits-deductions/child-tax-credit-non-filer-sign-up-tool. You can also use this sign-up tool to report your qualifying children born before the year 2021.

To successfully sign up through this tool, you need to have a primary home in the United States for more than half of the year. If you did not receive the 2020 Recovery Rebate Credit and want to get your third Economic Impact Payment, you can also fill in the details through this sign-up tool.

If you do not want to receive this stimulus, you can opt out through this site: https://www.irs.gov/credits-deductions/child-tax-credit-update-portal. The full $3,000 or $3,600 will instead be applied to your tax return when filed next year if you opt out.

You might also want to opt out once your income changes dramatically. If you continue to receive such a stimulus despite not being eligible for it, you will have to pay it back on your taxes by next year.