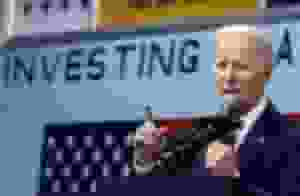

President Biden’s budget proposal for the next fiscal year has garnered attention for its plans to raise taxes on the wealthy to reduce the federal deficit. The budget has been scrutinized by the Tax Policy Center, which has evaluated how it would affect taxpayers depending on their level of income.

Biden’s Budget Proposes Major Tax Changes

The think tank’s analysis suggests that lower-income households could see a benefit from proposed expansions to the Child Tax Credit and the Earned Income Tax Credit. However, the wealthiest households could face a significant increase in their tax burden, with the highest rate of capital gains taxes potentially increasing from 20% to 39.6% according to CBS News.

The proposed budget also includes a 20% minimum tax on individuals with over $100 million in wealth, which would only affect around 20,000 U.S. households, but the impact could be substantial.

While Biden’s budget is not yet set in stone and will likely be subject to negotiations and revisions, it reflects the Biden administration’s push to increase funding for education, housing, and healthcare, among other priorities.

READ ALSO: Biden’s Tax Hike: Is Your Wallet Ready?

Middle-Class Families Would See No Changes

According to the Tax Policy Center, many middle-class families would see no changes in their after-tax income under Biden’s budget proposal. Overall, the budget aims to raise trillions of dollars in taxes to reduce the federal deficit by almost $3 trillion over the next decade.

The proposed tax changes have generated both support and opposition, with some arguing that raising taxes on the wealthy is necessary for funding critical social programs, while others argue that it could stifle economic growth.

Overall, President Biden’s budget proposal includes major tax changes that could impact taxpayers differently based on their income level. While the proposed changes are subject to negotiation and revision, they reflect the administration’s priorities to increase funding for social programs and reduce the federal deficit. The proposed tax changes have generated both support and opposition, and it remains to be seen how they will ultimately impact the economy and taxpayers.

READ ALSO: House Republicans Propose Bold Changes to Student Loans, Biden’s Debt Cancellation