$3,600 Stimulus Payment Expanded

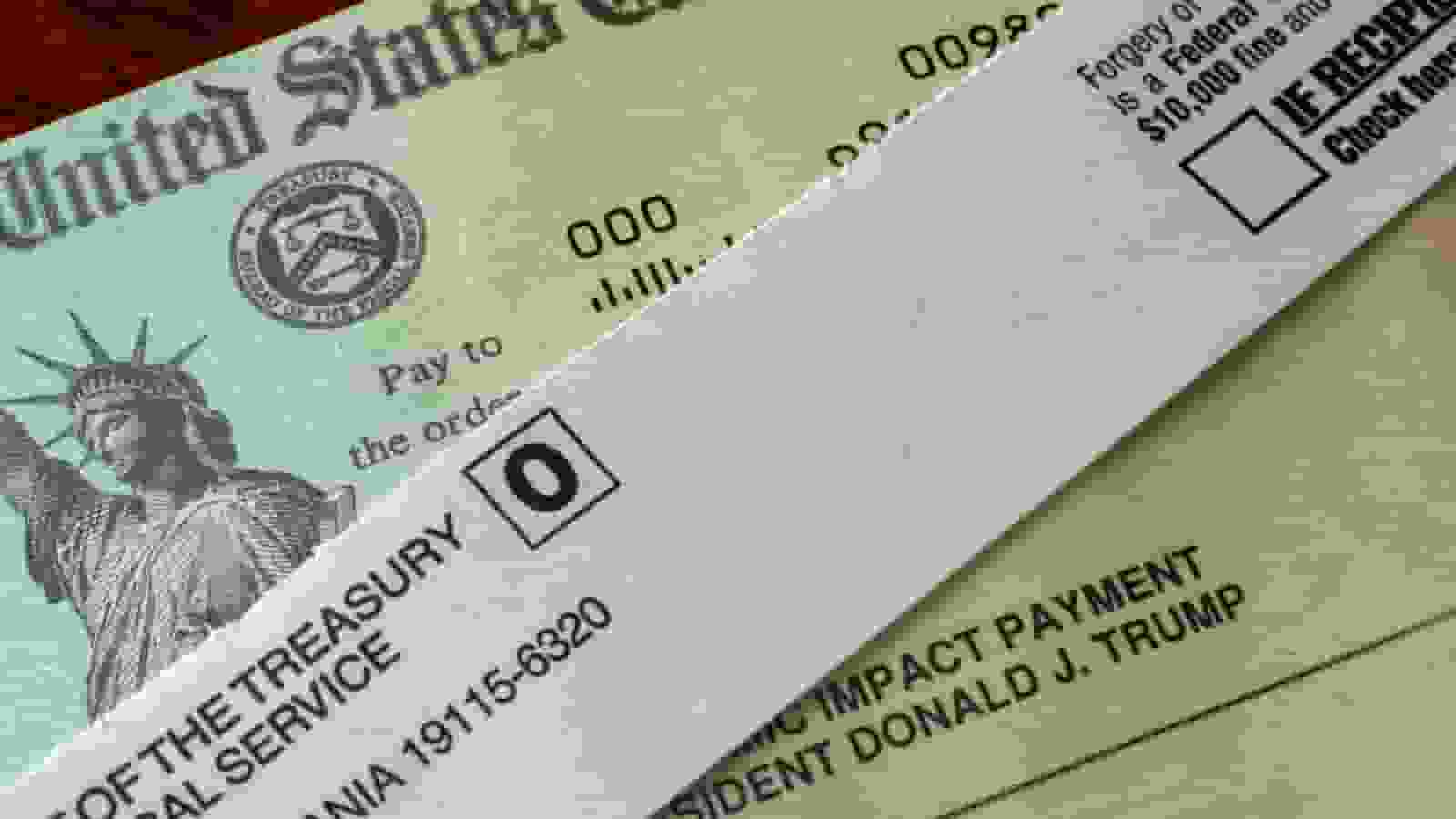

The US government expanded the Child Tax Credit (CTC) to $3,600 last 2021, allowing eligible families to receive advanced payments for each of the last six months of the year. However, a recent report from the Treasury Inspector General for Tax Administration revealed that the IRS failed to send the advance CTC to about 4.1 million households, leaving many eligible Americans without their stimulus.

If you think you may be owed the stimulus and the $3,600 CTC payment, you should consider checking with a tax professional. This money could make a big difference in your finances and help you catch up on bills or provide for your family.

READ ALSO: Child Tax Credit 2023: What American Parents Should Expect

Furthermore, if you’ve already claimed the 2021 CTC, it is now only worth $2,000 for 2022, as the expansion was not renewed by Congress. However, President Biden has announced his plan to restore the full Child Tax Credit and reduce child poverty in half, which is great news for families struggling to make ends meet.

To qualify for the full benefit, couples must make less than $150,000, and single parents who file as heads of households must make under $112,500 according to the IRS. Remember that tax credits aim to boost your refund or reduce your tax liability, so they can be a great help to your financial situation.

You should also keep in mind that some residents may further benefit if their states establish a child tax credit. So, if you think you may be eligible for the CTC or stimulus, don’t hesitate to check with a tax professional to see if you can claim what you’re owed.

In conclusion, the $3,600 stimulus payment and Child Tax Credit expansion is a great aid for many families in need, but not all eligible households have received their payments. So, it’s important to check your eligibility and claim what you’re owed to ensure your financial stability and security.

READ ALSO: Direct Payments Between $1,400 and $600 are to be Released In February – See If You Qualify