The school tax credit program is an important tool that can help schools adopt environmentally friendly practices and promote sustainability.

By providing financial incentives for schools to invest in renewable energy and energy-efficient equipment, the federal government is helping to create a greener future for our children.

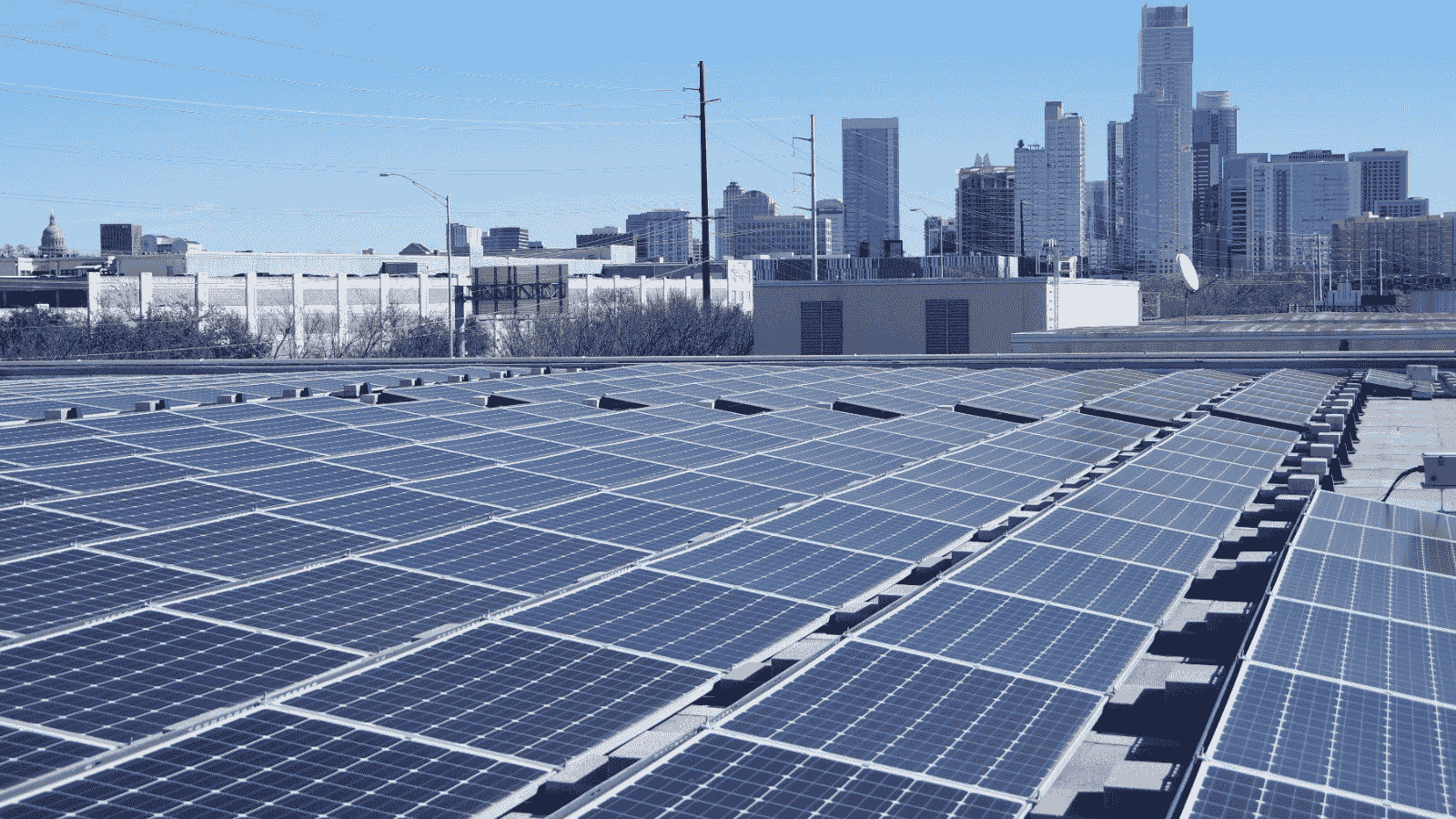

It is important for schools to take advantage of the school tax credit program and invest in green initiatives such as solar panels, electric school buses, energy-efficient heating and cooling systems, and water conservation measures. These initiatives not only reduce the carbon footprint of schools but also have significant cost savings in the long run.

According to Environment America, using this school tax credit, schools can generate their own renewable energy by installing solar panels and reducing their reliance on fossil fuels. In addition to reducing energy bills, schools that install solar panels can benefit from federal school tax credits, covering up to 26% of the installation cost. Similarly, electric school buses can help schools save money by reducing fuel costs and maintenance expenses while also contributing to a cleaner environment.

Furthermore, adopting sustainable practices can have positive effects on the health and academic outcomes of students. By improving air quality and reducing the risk of respiratory illnesses, schools can create a healthier learning environment for their students.

In conclusion, the school tax credit program is a valuable tool that schools should take advantage of to invest in renewable energy and energy-efficient equipment. These initiatives not only reduce schools’ carbon footprint and save money but also have positive impacts on student health and academic outcomes. So, if you are involved in school administration, consider exploring the school tax credit program and taking the first steps toward creating a greener future for your school and community.

READ ALSO: $450 Energy Relief Payments Are on the Way – See If You Qualify