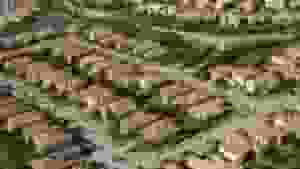

Among the high-priced housing in the nation is Prime real estate in Miami. The pandemic only accelerated this housing boom.

During the pandemic, housing in Florida had a massive boom in demand, with Tampa seeing some of the highest price increases in the nation. Home markets in Miami and Orlando also saw a big increase in housing costs. However, increasing mortgage rates are beginning to dampen the sectors’ enthusiasm.

Is Florida expensive to live in?

In determining how much money one needs to be able to afford a house in the 50 largest U.S. cities, Visual Capitalist analyzed the data from Home Sweet Home.

READ ALSO: U.S. Census Bureau: Estimates Show Texas Is Now Home to More than 30 Million People

These are the minimum annual incomes required to purchase an affordable house in Florida’s major metropolitan areas:

- Miami

Median home: $530,000 Salary needed: $103,744

- Orlando

Median home: $399,900 Salary needed: $79,573

- Tampa

Median home: $379,900 Salary needed: $75,416

- Jacksonville

Median home: $365,900 Salary needed: $73,465

The figures indicated the median price of a property in the United States is very close to $370,000. That means the median American household income has to be close to $76,000 before a home purchase would be a reasonable option.

But in states like California, among the highest in the nation where housing costs are in major metropolises like San Jose, San Francisco, and Los Angeles.

You’ll need to bring in around $337,000 to afford the median house price in San Jose, California, it’s the highest in the U.S. According to the statistics, the typical San Jose monthly mortgage payment is $7,718.

A research author concluded, “If someone is searching for luxury homes, even seven figures will bring you nothing in major metropolitan areas. For example, you one million dollars can barely buy 833 square feet of luxury housing in Miami.”

READ ALSO: Low Income Loans May Be Challenging For A Tight Budget – Here are 8 Low-Income Lenders