The Child Tax Credit is a tax benefit given to American taxpayers for each qualifying dependent child which was designed to help them support their families. But some American taxpayers complained about not getting the full amount of the Child Care Tax Credit.

The Child Tax Credit lowers taxpayers’ tax liability on a dollar-for-dollar basis. In 2020, the American Rescue Plan made the maximum annual credit raise from $2,000 per child under the age of 17 to $3,000 per child under the age of 18. For 2021, children younger than 6 received $3,600 and the 2021 credit was made fully refundable.

The federal government did not issue further stimulus checks. but leaders of some states started issuing monetary assistance on their own through forms of payments or tax credits.

READ ALSO: Nebraska Proposes State Child Tax Credit 2023

Some Americans made use of the monetary assistance given by several states, but some complained about not getting the full amount. Some recipients of the Child Tax Credit (CTC) said they received the money but not the whole amount stated in their checks.

Why am I not getting the full amount of the Child Care Tax Credit?

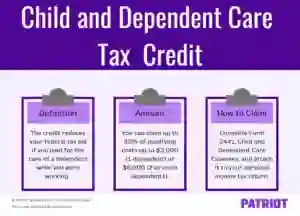

The CTC gives American taxpayers a credit benefit for each dependent qualifying child. But, if you have not received the full payment, you have to take several actions to solve your problem. You need to check your Dependent Care Expenses in both the Qualifying Dependent and Provider screens of the Credit section to make sure and verify that all details have been accurately entered into the system.

You must make sure that when you provided care, your dependent was under the age of 13. If you have a disabled spouse unable to care for themselves, you have to make sure they lived with you for more than half a year.

Internal Revenue Service’s official website says that any disabled person who is not physically or mentally able to provide care for himself or herself who lived with you for more than six months could be claimed as a dependent except if the disabled person earns 4,400 dollars or more.

READ ALSO: Who’s eligible for $1,200 stimulus checks for children?