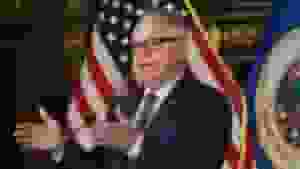

Minnesota Governor Tim Walz recently announced a $12 billion budget proposal with a series of measures focusing on kids and families, including a child tax credit from Minnesota.

The Bemidji Pioneer)

The proposal includes sending a child tax credit of $1,000 per child (maximum credit of $3,000) to lower-income families. The Governor’s office estimates that the child tax credit from Minnesota would result in over $1 billion in tax reductions between 2024 and 2027, and would decrease child poverty by 25%.

The package also includes expanding the Child and Dependent Care Credit. This program is expected to bring down the healthcare costs for 100,000 Minnesota households by offering up to $4,000 a year for childcare costs to families making under $200,000. Families with two children can receive up to $8,000 and families with three children can receive up to $10,500 under the proposed plan.

The proposal also calls for expanding the public pre-K seats for about 25,000 children, investing in early learning scholarships, as well as improving childcare access for families by boosting childcare assistance payment rates.

READ ALSO: Who’s eligible for $1,200 stimulus checks for children?

The proposal aims to address the childcare shortage by raising staff compensation and supporting providers starting childcare businesses. In addition to the measures focused on children and families, the proposal calls for reducing the special education cross-subsidy for school districts by 50%, setting aside $389 million in 2023-2025 and $424 million in 2026-2027 to provide universal school meals to make sure no student goes hungry at school and funding hiring more school counselors, nurses, psychologists, social workers, and chemical health counselors.

Overall, the Governor’s proposal is a comprehensive plan to improve the lives of children and families in Minnesota by reducing the cost of childcare, addressing child poverty, and providing more opportunities for children to succeed.

The proposal will have to be approved by the legislature and the Governor’s office before it can be implemented.

READ ALSO: Child Care Tax Credit Prioritized by Minnesota Democrats