The IRS started distributing $15 billion in August to families with 61 million children, according to the tax agency. The amount came in the form of child tax credit payments — the monthly series of checks that give parents a few hundred dollars per eligible child that they have. Now, another of those new child tax credit checks is just one week away and will be the third such payment as part of the six-check series that started on July 15. It will continue until December this year.

According to BGR, the money will start showing up in bank accounts to direct deposit recipients on Sept. 15. Those who opted to get their money through a paper check will have to wait for a few more days to arrive in their mailboxes. These payments combine to form one half of the overall child tax credit. A benefit that will be completed next year when families also get a companion tax credit.

After next week, there will be three child tax credit payments remaining. Those will come on Oct. 15, Nov. 15, and Dec. 15.

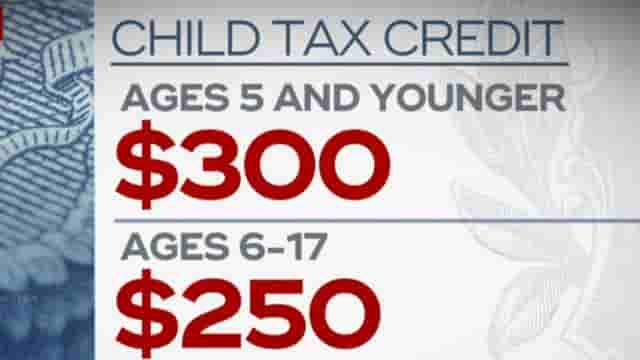

To be eligible for the child tax credit, a family must have at least one eligible child. The child will either be under the age of six bracket or the no older than 17 bracket. Recipients will get $250 if they have children between the ages of six through 17, and $300 for those who have children under six.

Aside from the incoming payment next week, recipients who received their first child tax credit payment as direct deposit and the second as paper check, should expect the third to be a direct deposit. The IRS said the paper check mistake for those expecting it to be a direct deposit was a technical issue, which they believe is already resolved for the third payment.

Further, the families who received their child’s tax credit through paper mail should watch out for the year-end summary, known as Letter 6419. They have to keep this letter because they will use it when filing for their 2021 federal income tax return by next year.

The IRS pointed out, “This is important because, for most families, the advance payments they are receiving during 2021 cover only half of the total credit. They will claim the remaining portion on their 2021 tax return.