The California Franchise Tax Board announced that the second round of the state stimulus checks would be released on Sept. 17. It is estimated that the second round will include the rolling out of around two million checks.

Accordingly, those eligible will receive the state stimulus checks through direct deposit. Your bank account information must be on file with the California Franchise Tax Board for the direct deposit to be made. Otherwise, if they have your address on file, you will most likely receive the check from Oct. 5 onwards.

The second round makes residents who made $75,000 or less on their 2020 tax return eligible for Golden State Stimulus II payments. The first round, called Golden State Stimulus I, focused on low-income Californians, and it included around 650,000 payments that went out.

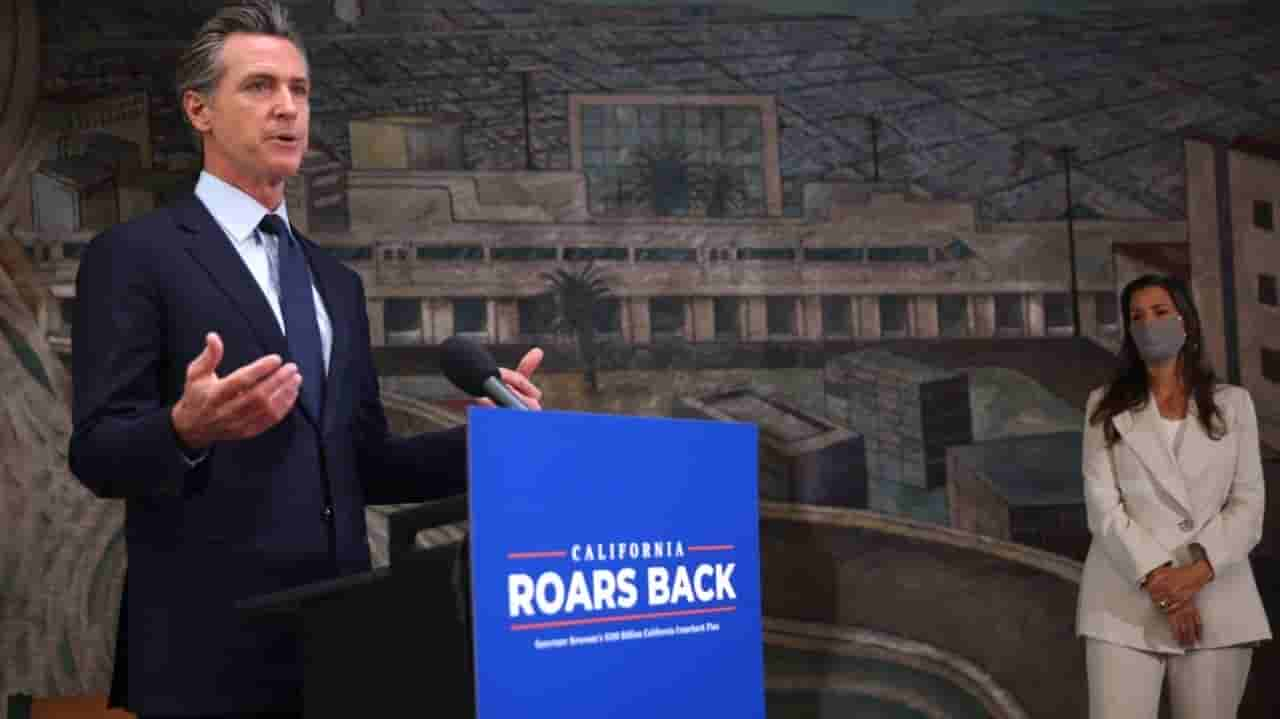

It is unclear how many more rounds of state stimulus check payments will the California government release. However, in a past statement, Governor Gavin Newsom pointed out that around two-thirds of Californians will be given some form of stimulus check payments as long as they are eligible. This two-thirds is said to include approximately 9 million qualified people. They expect that the other batch of tax returns due on October 15 will increase the number of eligible people.

Under the Golden State Stimulus, eligible residents will receive around $600 or $500 depending on their income and how many dependents they claim. People who did not receive a Stimulus I payment, but were eligible, will get at least $1,100 or more for Stimulus II.

The Golden State Stimulus was signed into law by Newsom in July, and this is the first of the state’s stimulus plans.