The United States government provides its citizens with an inflation stimulus check, enough money to cover emergency expenses. The public should review their eligibility for the Inflation Stimulus Check and consult this article for the most recent information.

Check the Inflation Stimulus:

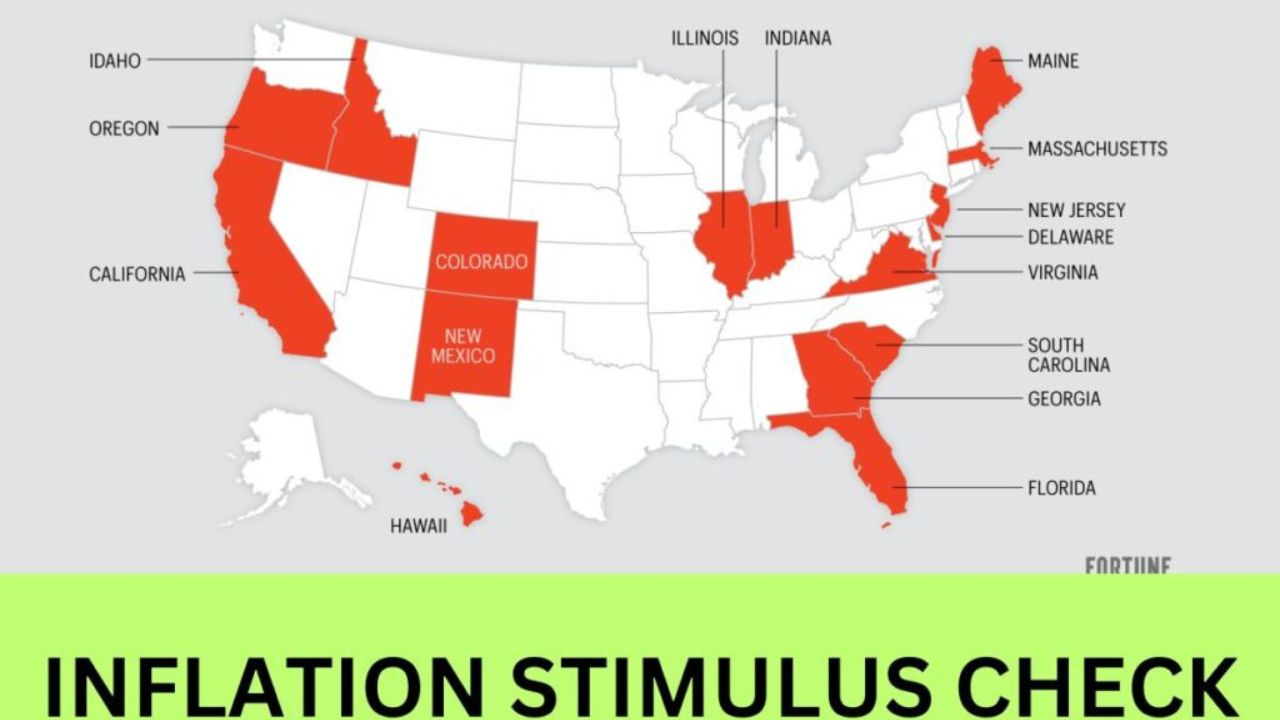

Americans feel the squeeze due to rising prices for daily necessities and services due to inflation. These days, inflation is prevalent and contributes to price increases. Most Americans are impacted by rising inflation, and purchasing everyday necessities becomes challenging for those in lower income brackets. States have chosen their strategies to deal with inflation and have been providing checks to Americans to offset the effects of inflation.

You can get IRS Inflation Stimulus Checks in California, Colorado, Maryland, Massachusetts, New Mexico, New York, Oregon, or Vermont. States differ in how much the checks are worth, but generally, they are between $100 and $1,000.

Before applying for the stimulus payment, people should ensure they are eligible for the inflation stimulus check. Estimates from the state indicate that more than 6 million individuals would get the payment, which aims to assist in lowering the growing expenses of housing, food, and necessities. Massachusetts intends to provide payments totaling $1200 to families with children and $600 to single people. Colorado and Maryland are utilizing a different strategy, using the money to expand other programs.

The Inflation Stimulus Check on irs.gov:

The Inflation Stimulus Check is a relief money given to people who have seen price increases due to inflation. States have multiple versions of the Inflation Stimulus Check. The information on the inflation stimulus check, which will be given shortly, is shown in the table below.

- Title: Stimulus Verification

- Month: 2023 November

- Organization: US Federal Government Department: Provincial Government Internal Revenue Service is the regulating body.

- Goal: To assist citizens during inflation; states offering the inflation stimulus check include Alaska, California, Colorado, Florida, Georgia, and Hawaii.

- Type of post: Finance

- IRS.gov is the website.

Qualification for the Inflation Stimulus Check:

- For eligibility for the inflation stimulus check, review the points below.

- The candidates must be citizens of the state where the inflation stimulus will be provided.

- The people must be from low-income categories, and there may be differences in the income thresholds.

- The person must have a current Social Security number.

- The individuals’ maximum age may differ.

- The Inflation Stimulus check payment is not available to non-tax filers.

Payment of the Inflation Relief Check:

The states that provide the payment of inflation stimulus checks are as follows.

- Millions of Californians will receive their tax refund in cash thanks to the IRS Inflation Relief Check program. A certain amount of money will be available to citizens of California; the income threshold is $250,000 or less for single people and $500,000 or less for heads of households or couples filing jointly. The beneficiaries must have lived in California for at least six months in 2020. The applicants must also be residents when they get their payout.

- Colorado recipients of the IRS Inflation Stimulus Payment Payment: $1500 was sent to couples filing jointly, while a check for $750 was sent to individuals filing singly. It is required that the individual submit a return for the year 2021, be a resident of Colorado County for that year, and be at least eighteen years old on December 31, 2021.

- Delaware individuals who have filed taxes for 2020 or 2021 or who will be 18 or older as of December 31, 2021, will get around $300 relief refund cheques from the IRS as an inflation stimulus. According to the most recent information, dual filers will receive $600. These people will only receive the refunds if they have submitted their 2020 tax filings. You may use the States website to check the status of your reimbursement.

- Florida Residents Who Have Already Taken Part in Assistance for the Needy Family Programs Are Eligible for a One-Time $450 Stimulus Check, Per Government Announcement. Payroll benefits will be available to the families raising the youngsters.

- Georgia’s IRS Inflation Relief Check: Those who have filed state returns for two consecutive years and have a tax burden in 2020 will get a refund from the Georgian government. Individual taxpayers will receive $250, the head of the household will receive $375 in inflation relief, and couples filing jointly will receive up to $500 in relief. The money will come in the form of paychecks or direct transfers. The IRS Inflation Relief Check will be issued to the person even if they haven’t submitted their taxes yet.

- Hawaii residents who qualify for the IRS Inflation Relief Check will get a one-time tax refund that varies based on their income in 2021; for single taxpayers who have earned less than $1,000,000 and for joint taxpayers who have made less than $2,000,000, a relief payment of $300 will be given. A family of four will receive $1200 since each dependant will receive $300. The recipients will receive $100 apiece if their income exceeds $1 lakh or $2 lakh.

- Idaho individuals who have filed their income taxes for 2020 and 2021 will get extra rebates from the government as part of the IRS Inflation Stimulus Check. The bonus refund for individuals filing solo taxes is $300; for joint filers, it is $600; both amounts represent 10% of the income tax paid, whichever is lower. The previous year’s tax refund awards each taxpayer $75 or 12% of the income tax paid, whichever is higher.

- Illinois: Individuals filing as singles for $2 lakh in 2021 will receive a one-time income tax refund of $50, while those filing jointly for $4 lakh will receive a $100 refund. As dependents, the tax filers will receive $100. Payments will be made either by postal check or direct deposit. As homeowners, they will receive a $300 extra refund provided their total income does not exceed $5 lakh.

- IRS Inflation Stimulus Check Indiana: regardless of income level, single and joint taxpayers for 2020 will get a one-time reimbursement of $125 and $250. The residents received cheques in the mail and direct payments of the monies earlier in the summer. Payments submitted via mail should be anticipated to take some time to process.

- Maine residents who paid taxes in 2021 and made less than $1 lakh would receive a $850 payout from the IRS Inflation Relief Check. The Inflation Stimulus Check will pay the couples $1,700 each.

- Minnesota is receiving stimulus cheques from the IRS to help with inflation relief for workers affected by the epidemic. A one-time payout of $750 is available to employees who worked more than 120 hours in person between March 15, 2020, and June 30, 2021.

- New Jersey’s IRS Inflation Relief payment: The state is providing a $500 stimulus payment to married couples making less than $150,000 or to people making less than $150,000 soon. Additionally, homeowners who earn up to $150,000 are eligible for a property tax credit. If the tenants make less than $450, they will receive $450 cheques.

- New Mexico’s IRS Inflation Relief Check: Tax refunds for 2021 have been authorized for taxpayers in New Mexico. Couples making less than $150,000 will receive $500 as an inflation benefit. A further rebate of $500 for individual filers and $1000 for joint filers was given out later in the year.

- IRS Inflation Stimulus Check Oregon: This one-time payment is given to taxpayers in the state who have been residents for at least six months and qualify for it.

- Rhode Island IRS Inflation Relief Check: The maximum amount of $250 the state will give each kid instead of an IRS Inflation Stimulus Check is $250.

- Virginia taxpayers receiving an IRS Inflation Stimulus Check will be paid $250 if single filers and $500 if married.

When Will the IRS Issue an Inflation Relief Check?

The dates of the inflation stimulus check on irs.gov are as follows.

- Payment shall be made on May 23, 2023, if the Social Security Number’s final two digits fall between 0 and 9.

- Starting May 30, 2023, payment will be made if the Social Security Number’s final two digits fall between 10 and 49.

- Starting June 6, 2023, payment will be made if the Social Security Number’s final two digits fall between 50 and 99.

Read Also – CWB Payment Dates 2024. Who is eligible for $1428 CWB?