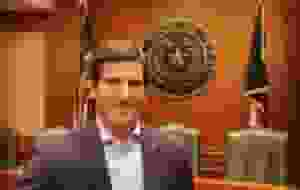

Texas State Representative Landgraf Fights for Tax Relief

Texas State Representative Landgraf believes that every level of government should operate with transparency and that the 2023 Texas Legislative Session will make a significant difference in the pocketbooks of Texans.

Proposals of Texas State Representative Landgraf

According to Odessa American, one of Texas State Representative Landgraf’s proposals is a property tax reform package that would cap the increase in appraised values of all types of property at 5%. Presently, under Texas law, all other properties have no appraisal caps while the appraisal increases for homestead properties are only capped at 10%. This across-the-board appraisal cap will be a valuable tool for every Texas taxpayer.

READ ALSO: Student Debt Relief Case: Texans Await Supreme Court Ruling

Texas State Representative Landgraf has supported efforts to reduce the property tax burden on Texans by increasing the homestead exemption to $25,000. He is also reforming the property tax system to make it more transparent, and allocating $5 billion to provide property tax relief by lowering tax rates in 2020 and 2021.

Texas State Representative Landgraf is spearheading several bills during the session that will increase government accountability and slash taxes in the state. These bills include:

- House Bill 2: This includes a provision to cut ISD property taxes by 28% using the budget surplus.

- HJR 111: this is to amend the Texas Constitution by creating The Texas Severance Tax Revenue and Oil and Natural Gas (STRONG) Defense Fund, which will re-invest state oil and natural gas production tax (aka “severance tax”) revenue back into the communities responsible for generating the majority of that revenue.

- HB 187: this requires any ballot measure for approval of the issuance of bonds or other public debt to be submitted to voters and taxpayers only during a November election.

- HB 2213: This is to relieve the tax burden on Texas small businesses

- STRONG funds will help address everything from teacher and nursing shortages to potholes and property tax relief.

Texas State Representative Landgraf said he will always fight for transparency and accountability at all levels of government. Landgraf’s proposals aim to make life in Texas better than it was yesterday, for a better tomorrow where Texas homeowners aren’t renting out their homes from local governments and being taxed out of business by their state.

READ ALSO: Claim Food Rebates Up To $302 Now! Before it’s Late