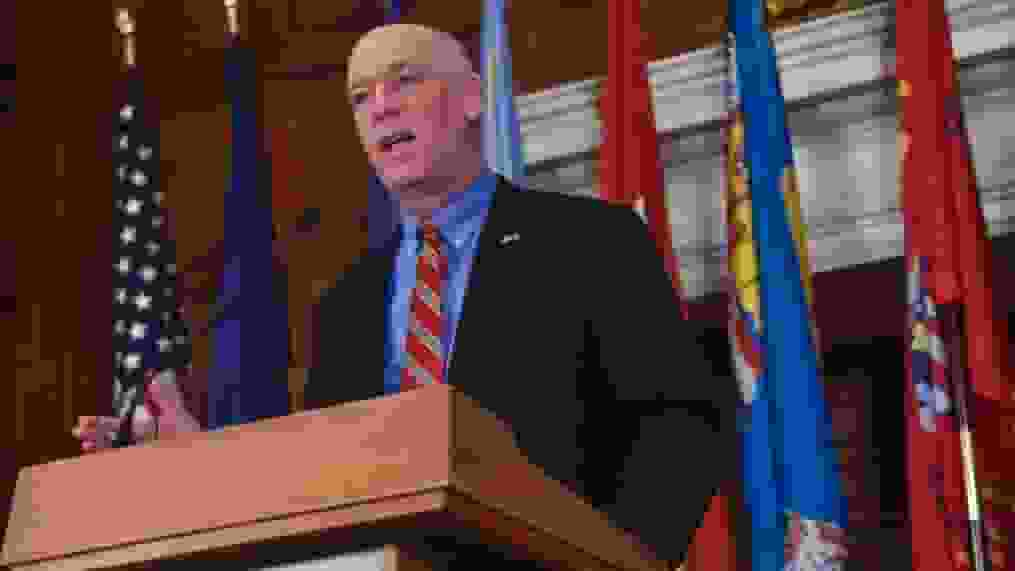

Montana Governor Greg Gianforte Signed a Package of Bills

Montana Governor Greg Gianforte recently signed a package of bills aimed at providing tax rebates and long-term tax reductions for Montana taxpayers.

These are the bills signed by Montana Governor Greg Gianforte:

- House Bill 192 which sets aside $480 million of the surplus to provide income tax rebates. The rebates can be up to $1,250 for those filing individually and $2,500 for those filing jointly.

- House Bill 222 uses another $280 million to provide property tax rebates of up to $1,000 each of the next two years on Montana property owners’ primary residences.

- Senate Bill 212 makes two significant tax changes: dropping the top income tax rate from 6.5% to 5.9% starting in 2024 and more than tripling the state-earned income tax credit for lower-income families.

- House Bill 212 which exempts businesses from paying the state’s business equipment tax on equipment valued up to $1 million,

- House Bill 221 which replaces the current tax rates for long-term capital gains with reduced rates for those gains.

- House Bill 251 puts $150 million toward paying off state debt,

- House Bill 267 places $100 million into a new state account, where it can be used as matching funds to secure federal road and bridge grants.

- Senate Bill 124 simplifies the state’s corporate income tax calculations to use a single factor based on sales, starting in 2025.

READ ALSO: Get Ready for an Extra SSI Check on March 31!

Montana Governor Greg Gianforte and Republican lawmakers hailed the bills as a significant step for Montana taxpayers, with Gianforte stating that they would make it easier for Montanans to raise a family, earn a good living, own a home, retire comfortably, and achieve the American dream.

Republican lawmakers praised the bills signed by Montana Governor Greg Gianforte, claiming that they are leading the charge for taxpayers, just as Thomas Meagher did. According to Rep. Bill Mercer, R-Billings, the legislation is a promise delivered. When campaigning in the fall, Republicans said that they would shock the public by taking money out of the Treasury and giving it back to them.

However, according to Missoula Current, Democratic lawmakers have been critical of the Republican majority for advancing the package so quickly and for how the benefits would be distributed by Montana Governor Greg Gianforte.

House Minority Leader Rep. Kim Abbott, D-Helena, and Senate Minority Leader Sen. Pat Flowers, D-Belgrade, released a statement repeating their opposition, saying that the package does nothing to help to work- and middle-class families get through the cost of living crisis. They also raised serious questions about the package’s constitutionality.

Regardless of the opposition, the bills signed by Montana Governor Greg Gianforte are now law. The Montana Department of Revenue will begin working on plans for implementing the tax rebates, and the income tax rebate is expected to be distributed automatically later this year.

READ ALSO: $7.5 Million Refunds From American Airlines Settlement: Apply Now!