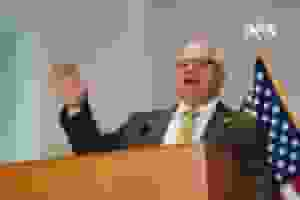

Governor Tim Walz of Minnesota has proposed a massive $65 billion two-year budget, which includes $11.2 billion in new state spending and $5.4 billion for what the governor calls the “biggest tax cut in state history.” However, the proposal also includes new taxes and fee hikes. This has sparked a debate between Democrats and Republicans over the state’s budget surplus of $17.6 billion.

Walz’s proposal includes a new payroll tax for workers and businesses to fund a paid leave program, an increase in the seven-county metro sales tax, higher capital gains taxes, increased fees on car registrations, and more.

Governor Tim Walz says that Minnesotans are willing to pay more taxes if they believe they are fair and will improve life. However, Republican leaders do not think residents will be as supportive of the proposed tax hikes given the state’s budget surplus. They argue that residents want permanent tax cuts.

READ ALSO: FAIR TAX ACT: A CLOSER LOOK AT THE REPUBLICAN PLAN FOR TAX REFORM

Walz’s proposal includes a new child tax credit of $1,000 per child with a cap of $3,000, rebates worth $1,000 to individuals and $2,000 to households with income limits, and a reduction in state taxes on Social Security. Governor Tim Walz has also proposed a 15% tax on cannabinoid products and a 15% tax on adult-use cannabis. The proposal also includes increased fees for items like fishing licenses and state park passes and a hike in registration fees for newer vehicles.

The governor’s budget proposal will now be examined by House and Senate committees while they craft their own proposals. Democrats have narrow control of both chambers of the Legislature, so Governor Tim Walz may get a lot of what he wants, but there are also competing proposals, including those hoping to eliminate taxes on Social Security. The budget will have to be completed by July 1, the start of the fiscal year.

In conclusion, Governor Tim Walz’s budget proposal has sparked a debate over taxes and spending in Minnesota, with both parties proposing their own ideas for how to allocate the state’s budget surplus of $17.6 billion. The proposal includes new taxes and fee hikes but also includes tax credits for families and rebates, as well as a reduction in state taxes on Social Security. The final budget will likely be a compromise between the governor’s proposal and the proposals of the House and Senate committees.

READ ALSO: INCOME TAX ELIMINATION PROPOSAL SPARKS DEBATE OVER STATE FINANCES