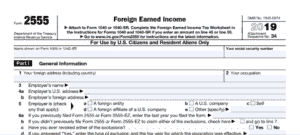

Form 2555 is a tax form that allows American citizens working and living abroad to exclude foreign income from their U.S. taxes. This form is used to claim the Foreign Earned Income Exclusion, which can save expats a lot of money come tax season.

The Foreign Earned Income Exclusion exists to prevent double taxation and helps protect Americans earning income abroad from being taxed twice – once by the U.S. and once by the country in which they earned the income.

To be eligible to file Form 2555, expats must be working outside the U.S. either as an employee, self-employed or in a partner capacity. They must also pass either the Bona Fide Residency Test or the Physical Presence Test. Employees of the U.S. government cannot claim the foreign income exclusion, but employees of private companies under contract with the U.S. government may still be eligible.

READ ALSO: Expert Warns about Common Retirement Regret

The Bona Fide Residency Test requires expats to prove that they have more ties to the foreign country than the U.S., have been a resident of that country for an uninterrupted tax year, be a U.S. citizen or a resident alien of a foreign country with an income tax treaty with the U.S., earn active income, and have a permanent place of work in a foreign country. To qualify using the Physical Presence Test, expats must prove that they have been living outside the U.S. for 330 full days in a year.

Form 2555 instructions can be found on the IRS website, but it is recommended that a seasoned tax professional handle the form to avoid costly mistakes. The foreign earned income exclusion for the 2022 tax year is up to $112,000.

In conclusion, Form 2555 is an important tax form for American citizens working and living abroad. It allows them to exclude foreign income from their U.S. taxes and prevent double taxation. Expats who are eligible to file this form should take advantage of the Foreign Earned Income Exclusion to save money and ensure that their taxes are done right.

READ ALSO: Brace Yourself for a Smaller Tax Refund, Here’s Why and What You Need To Know